By Lauren Fox, CNN

(CNN) — The Trump administration has just days to respond to a request from House Ways and Means Committee Chairman Richard Neal to turn over six years of President Donald Trump’s business and personal tax returns.

But, while the deadline is Wednesday, the showdown for the tax returns is expected to last much longer as both sides dig in.

What happens next is not immediately clear, though the legal posturing on both sides suggests that a court battle could be on the horizon. Before that, however, expect the team behind the President and the team behind Neal to produce a lot of paperwork supporting why they’re right and the other is wrong.

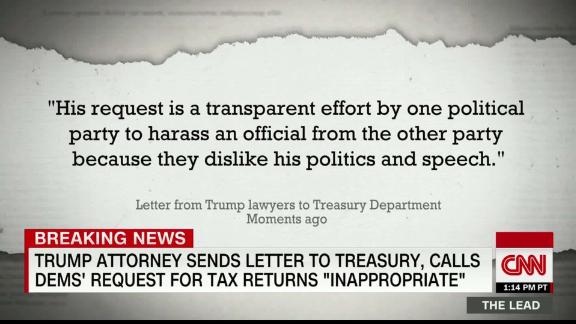

Trump has been clear he has no intention of making this fight easy. On Friday, his lawyers sent a letter to the Department of Treasury’s counsel dismissing the request for tax returns as a politically-motivated pursuit, writing that “Ways and Means has no legitimate committee purpose for requesting the President’s tax returns or return information. While the committee has jurisdiction over taxes, it has no power to conduct its own examination of individual taxpayers.”

“The idea that you can use the IRS as a political weapon is incorrect as a matter of statutory law and constitutionally” Trump lawyer Jay Sekulow said Sunday on ABC’s “This Week.” “We should not be in a situation where individual private tax returns are used for political purpose. What stops another party from doing the same thing by the way.”

But, Neal — who spent months preparing a case to obtain Trump’s tax returns — won’t take no for an answer. Using a little-known provision in the tax code, the Massachusetts Democrat is requesting the tax returns under 6103, a statute that allows the chairman of House Ways and Means panel to make requests for individuals’ tax information. Neal and Democrats have argued that the law clearly states that if the chairman asks for the information, the secretary of the Treasury “shall furnish” it.

“This was a very reasonable approach,” Neal told reporters last week. “We wanted to make sure that the case we constructed was one that stood up under the critical scrutiny of the courts.”

He added that if the IRS still doesn’t respond they will decide on next steps but he assured us “surely there will be one.”

An aide close the process told CNN that Neal is expected to send at least one followup letter, reiterating his request maybe even more, but that the steps after that are still being discussed. Tax law experts are divided about whether or not Neal would issue a subpoena on top of his request or whether the 6103 authority implies the power to receive the information on its own. In that case, the question is whether a subpoena actually undermines the chairman’s 6103 authority.

“A subpoena is a tactical decision. It is not required,” said Andy Wright, former associate counsel for President Barack Obama.

Before the request was made last week, liberals on the committee had pushed Neal more and more publicly to seek Trump’s returns but Neal moved on his own timeline, cognizant of the political storm that would ensue after he sent his official letter.

Trump’s attorneys have also been preparing for the anticipated request, a source close to Trump’s legal team told CNN.

“We’ve been looking at this issue for several months,” the source said.

Why American may never see Trump’s tax returns

The legal road ahead is a long one. The 1920s era law is largely untested in court with vast questions remaining about how broad a chairman’s congressional authority is. While 6103 requests are made all the time for compiling research, the request of an individual’s personal tax returns as high-profile as the President has raised questions. And, if Neal gets the returns, there are questions about how much he would publicly be able to share.

Even if Neal obtained Trump’s tax returns and the other tax information he’s requested after a protracted legal battle, the public still won’t automatically see them. Instead, the chairman would get the returns and then under the law he alone would have the authority to look at them unless he designates others to see them. Those designees could include members of the committee or members of the Joint Committee on Taxation. Once those individuals have the power to look at the tax information, they are subject to harsh punishments if any of the information is leaked. That penalty is $250,000 fine and five years in prison per infraction. It’s serious.

If Neal wanted to make the returns public — and Neal has not said what he plans to do with the returns if he obtained them — there is a process. Neal would put the committee into a private session and then the committee would vote.

That would be a rare event. The last time Congress made the decision to disclose private tax information was during the fight over whether the IRS was discriminating against conservative groups. Then, however, the vote was bipartisan. Releasing Trump’s tax info would likely split along party lines.

What would the returns even show?

There are still real questions about how informational Trump’s tax returns would even be. Six years of returns including two while Trump was President will paint some picture, but not necessarily a comprehensive one. That is why while Neal is asking for tax returns, he is also asking for “all administrative files” including “workpapers, affidavits, etc.”

Tax returns can’t tell the committee everything, but the administrative files could be more revealing including worksheets and audit reports. This is where the committee would actually learn how the presidential audit process works, and if Trump was under audit as a private citizen.

The-CNN-Wire

™ & © 2019 Cable News Network, Inc., a Time Warner Company. All rights reserved.